A 40% Surge! China's H1 2025 Pesticide TC Performance Review is Out!

Introduction:

In the first half of 2025, China's pesticide Technical Concentrate (TC) market delivered a significant performance report. Behind a nearly 40% surge in registrations lies a profound evolution of the industry landscape: resources are rapidly concentrating in specific categories, leading products, and top-tier companies, while green and safe principles form the solid foundation for the industry's development. This article provides a comprehensive review of the 119 new TC registrations in H1 2025 to paint a picture of the current market map and future trends.

I. Core Data: Soaring Market Activity and Strong Growth Momentum

In H1 2025, China's pesticide TC registration activity demonstrated unprecedented vitality.

Number of New Registrations: A total of 119 products were proposed for approval, a remarkable year-on-year increase of approximately 40%. This significant growth is a direct reflection of market confidence and the accelerating returns on corporate R&D investment.

Innovation and Exports: The registrations included 2 new pesticide active ingredients and 14 TCs designated for export only, showcasing the Chinese pesticide industry's dual focus on independent innovation and global expansion.

Overall, the high-speed growth in pesticide TC registrations signals that the industry is in an active and upward cycle.

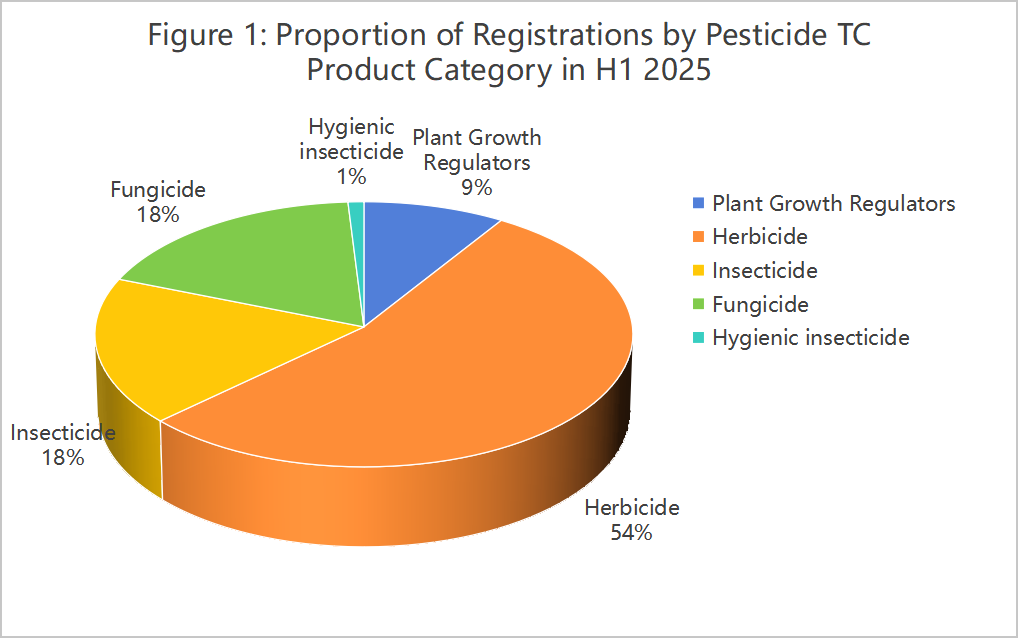

II. Category Landscape: Herbicides Lead with an Absolute Advantage

The flow of resources indicates the market's core focus. Registration data from the first half of the year shows a stark differentiation in category structure.

Herbicides (64 registrations): Dominating the field, herbicides accounted for 54% of all TC registrations. This clearly indicates that managing weed resistance and ensuring stable yields for field crops remain the central pain points in agricultural production.

Insecticides & Fungicides (22 and 21 registrations, respectively): These two categories were evenly matched, together contributing about 36% of the share and forming the two main wings of the market.

Plant Growth Regulators & Others (12 registrations): As supplementary products, they made up the remaining 10% of the share. The urgent need for integrated management solutions is the primary driver behind this structural differentiation in TC registrations.

III. Analysis of Core Products: Significant "Blockbuster" Effect and Increased Product Concentration

An analysis of specific active ingredients reveals that market resources are highly concentrated in a few efficient, broad-spectrum "blockbuster" products.

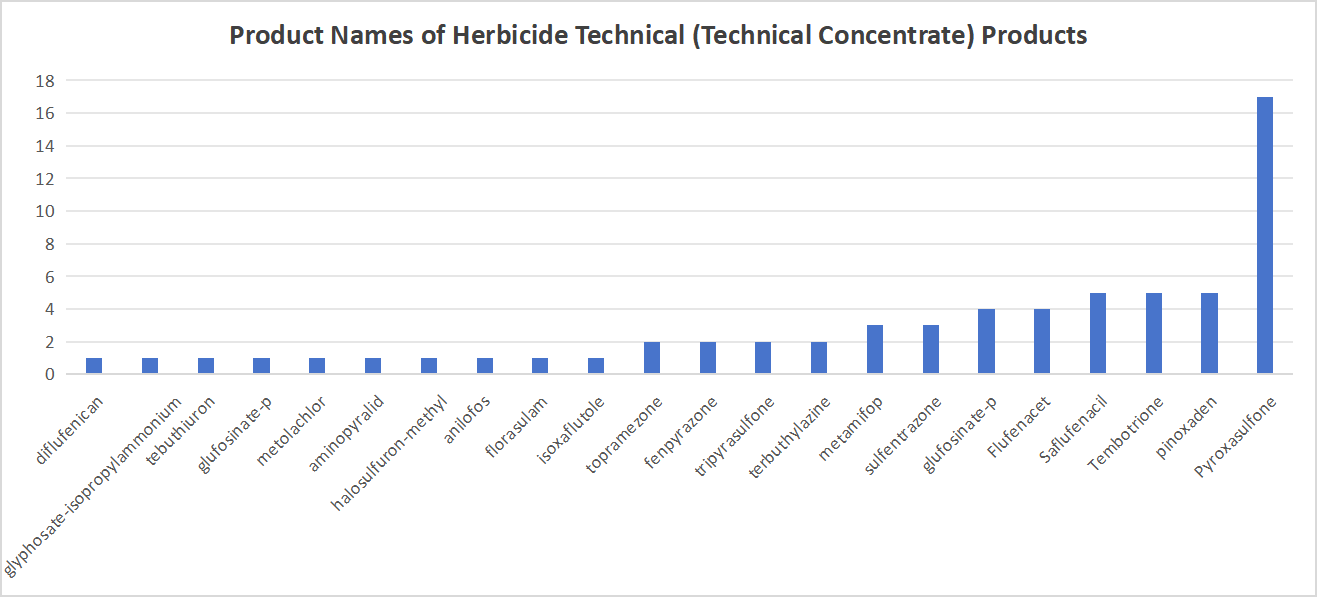

Herbicide Sector:

Topramezone stood out with 17 registrations, demonstrating its exceptional market potential. Bipyrazone, cyclosulfamuron, and pinoxaden (5 registrations each) formed a solid second tier. Varieties like glufosinate-P ammonium salt and flufenacet were also active, collectively representing the current hotspots for herbicide TC research and registration.

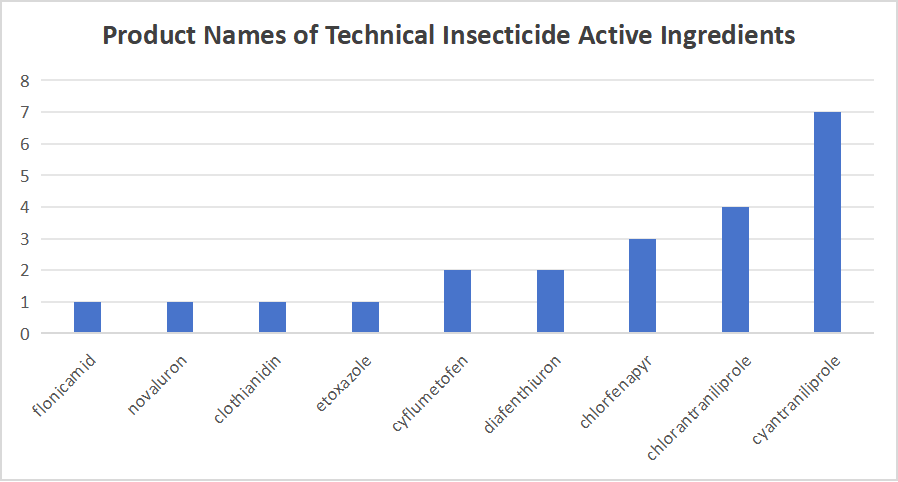

Insecticide Sector:

High-efficiency insecticides, represented by the diamide class, continue to dominate the market. Cyantraniliprole (7 registrations) and chlorantraniliprole (4 registrations) together accounted for over half of the registrations in this category. Chlorfenapyr (3 registrations) also maintained a high level of market attention.

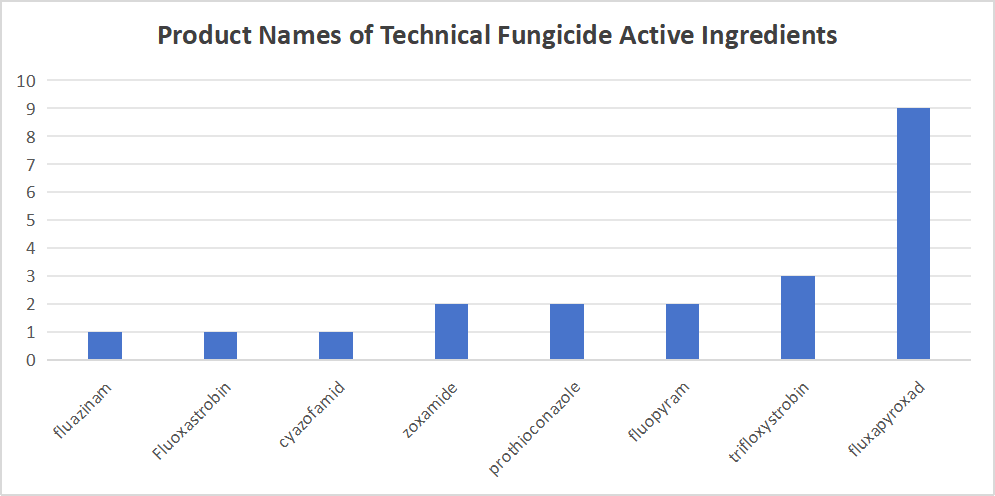

Fungicide Sector:

Fluxapyroxad emerged as the leader with 9 registrations, further solidifying its dominant market position. Trifloxystrobin (4 registrations), a classic active ingredient, remains a key focus for companies. In addition, zoxamide, prothioconazole, and fluopyram also demonstrated strong market competitiveness.

Plant Growth Regulators (PGRs):

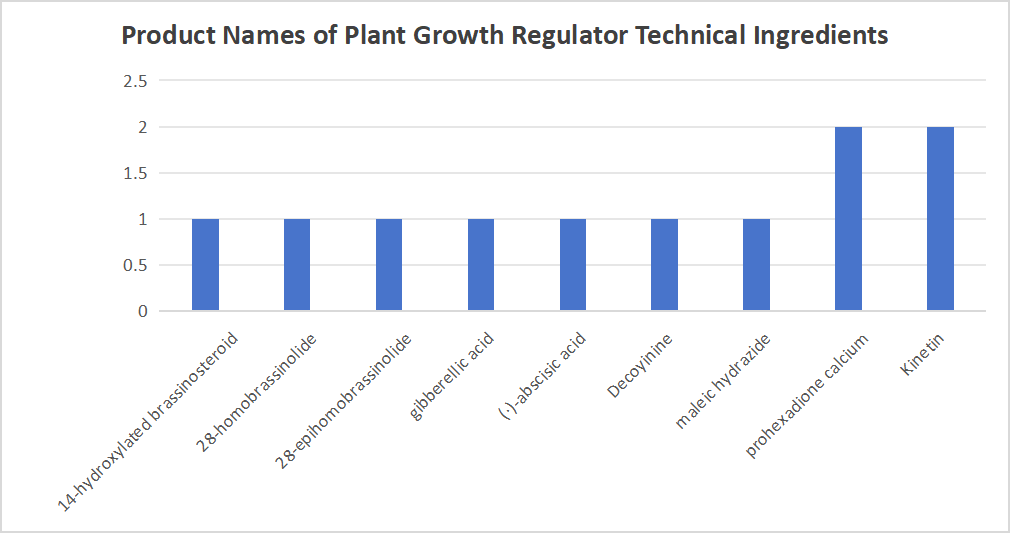

In H1 2025, China proposed the approval of 11 new PGR TC products, covering 9 different active ingredients. Prohexadione-calcium, kinetin, 14-hydroxybrassinosterol, 28-homobrassinolide, 28-epihomobrassinolide, and gibberellic acid continue to be popular products for PGR TC registration.

IV.Two Core Driving Forces: Green & Safe Principles and Independent Innovation

Beneath the surface of quantitative growth and market concentration lie two fundamental drivers of industry development.

Green & Safe as a Hard Requirement: A crucial signal is that none of the new TCs registered in H1 2025 were classified as highly toxic or acutely toxic; the vast majority were of low or slight toxicity. This shows that, guided by policy and market preference, low-toxicity and eco-friendly are no longer an "optional choice" but a "mandatory requirement" for a company's survival and development.

Seeking Breakthroughs through Independent Innovation: The 2 new pesticide active ingredients registered are both microbial nematicides, representing innovative breakthroughs in a niche area of biopesticides. This suggests that future competition will rely more on technological innovation than on simple production capacity expansion.

V.Conclusion and Outlook

Reviewing the pesticide TC registrations of H1 2025, we can clearly identify three major trends:

Structural Focus: Market resources are concentrating on herbicides, particularly on a few blockbuster herbicide products, as never before.

The Strong Get Stronger: The advantages of leading companies in R&D and registration are becoming more pronounced. The "Matthew Effect" in the industry is intensifying, and concentration is steadily increasing.

Green-Oriented Development: Safety and environmental protection have become the foundational principles and consensus of the industry, acting as the core force driving product iteration.

This performance review is not just a summary of the first half of the year but also a forecast for the future. A new landscape for China's pesticide industry—one that is more concentrated, more technologically advanced, and greener—is rapidly taking shape.